The holiday season lasts from late November to early January, and while retail fraud occurs year-round, it increases dramatically during the holiday season. This year, fraud has increased by 14% compared to the rest of the 2020 retail season, according to a study conducted by TransUnion, a major consumer credit reporting agency.

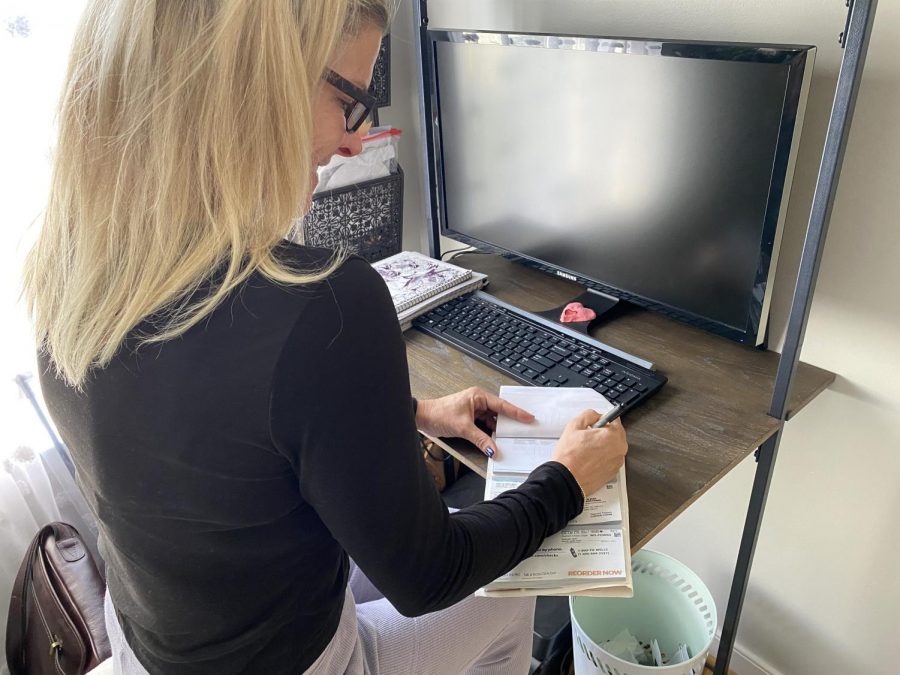

Check fraud is one of the major types of fraud experienced by retailers since many major retail stores accept checks. These stores include Target, Publix, Staples, Dollar Tree and Macy’s, among others. While debit and credit card use is on the rise, check use still maintains a steady flow. Small businesses prefer to have written checks as opposed to cash or card transactions because of convenience as well as fees associated with card transactions. As reported by software developer Intuit Inc., many of these small companies do not have the money to pay the required fees to accept credit cards as a business. Thus, small businesses are among the most likely to experience check fraud and should look out for fraudulent checks, especially during the holiday season. A few ways to identify a fraudulent check are if the check is missing an address or has a handwritten address, the bank name is written or misspelled, or if check colors smear when rubbed with a wet finger (this suggests printing using a color copier).

In the digital age, tactics used to commit fraud to earn a profit continue to evolve. Return fraud has continued to spread throughout retail stores in the U.S. Fraudsters have invented multiple ways to commit return fraud, which include purchasing an item and returning it with duplicate receipts to receive additional refunds.

Midlo small business owner Sean Gay has avoided experiencing return fraud by staying away from products that have high rates of return fraud. “Video games, video game systems, electronics and high-value collectibles see lots of return fraud,” Gay said. One instance where Gay experienced return fraud involved a set of LEGOs that a customer had returned. “I opened the box of Legos and it was full of mulch,” Gay said. Many fraudsters will fill toy boxes with pebbles or mulch because they know that larger stores won’t check inside the box before they give them their money back. Small business owners have a greater risk of losing money from return fraud than large corporations because big-box stores such as Walmart or Target build in at least 1% of their budget to account for fraud, rather than spending money to stop or punish those who commit fraud.

To help small business owners in Midlothian, the community can educate itself about check and return fraud and start shopping locally.

For more information about retail fraud, click here.